Retirement Insecurity 2024: Americans’ Views of Retirement

This national opinion research finds 83% of Americans believe all workers should have a pension, 79% say the nation faces a retirement crisis, and they want action now on Social Security.

2024 was a year to remember when it comes to improving retirement prospects for workers. Most notably, pensions now are increasingly part of the conversation about strengthening the nation’s retirement infrastructure.

The National Institute on Retirement Security’s unique, fact-based research on the benefits of pensions for employers, workers, and the economy is having an impact and changing the retirement conversation.

2024 was an election year in which Americans expressed high anxiety about the economy and their personal finances. Amid this backdrop, the 2024 research agenda focused heavily on Americans’ views of their economic security in retirement.

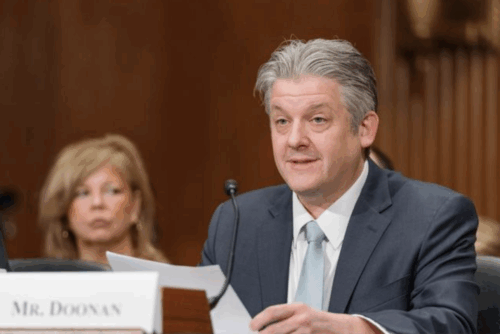

A key moment in 2024 was NIRS testimony before the U.S. Senate on the nation’s retirement crisis. NIRS Executive Director Dan Doonan testified to lawmakers that most Americans will not have enough money for a financially secure retirement, and NIRS data is clear that we need to rethink our nation’s retirement infrastructure because the current system is leaving the middle class behind.

NIRS progress is possible because of the support of NIRS members. NIRS deeply appreciates the continued commitment from its broad membership base. Many members have been with NIRS since the organization launched in 2007, and their steadfast commitment is having a real impact on improving the retirement outlook for all Americans.

This national opinion research finds 83% of Americans believe all workers should have a pension, 79% say the nation faces a retirement crisis, and they want action now on Social Security.

Employees’ Retirement System Of Rhode Island: Examination Of Turnover Trends Since Retirement Reforms finds shifting employees in the Employees’ Retirement System of Rhode Island (ERSRI) from defined benefit pensions in 2012 to a hybrid retirement plan is causing demonstrable changes in public employee attrition.

In response to a request for information issued by the U.S. Senate Health, Education, Labor, and Pensions (HELP) Committee, the National Institute on Retirement Security has submitted a research issue brief with policy ideas to help expand defined benefit (DB) pension coverage for private-sector employees. The research brief, Policy Ideas for Boosting Defined Benefit Pensions […]

Women face an uphill climb when it comes to preparing for retirement. They earn less than men, often take time away from the workforce for caregiving, they live longer, and are less likely to have access to a retirement plan at work. In fact, U.S. Census Bureau data show that half of women ages 55 […]

“Today, retirement security is out of reach for many Americans. The data indicate that most Americans, particularly middle‐class workers, are falling far short when it comes to saving enough money for afinancially secure retirement.”