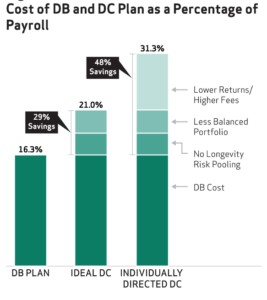

Evolution and Growth: How Public Pension Plans Have Diversified Their Investments Amid Changing Markets

A report from the National Institute on Retirement Security (NIRS) and Aon examines the changes public pension plan investing has undergone throughout the twenty-first century.