New NIRS research finds retirement savings are dangerously low, and the U.S. retirement savings deficit is between $6.8 and $14.0 trillion.

These findings are contained in a new research report, The Retirement Savings Crisis: Is it Worse Than We Think?, located here.

The study broadly examines how American households are faring in relation to retirement savings targets recommended by some financial services firms. It uses the Federal Reserve’s Survey of Consumer Finances to analyze retirement plan participation, savings, and overall assets of all U.S. households age 25 to 64, not just those with retirement account assets. This is important because some 45 percent, or 38 million working-age households, do not have any retirement account assets.

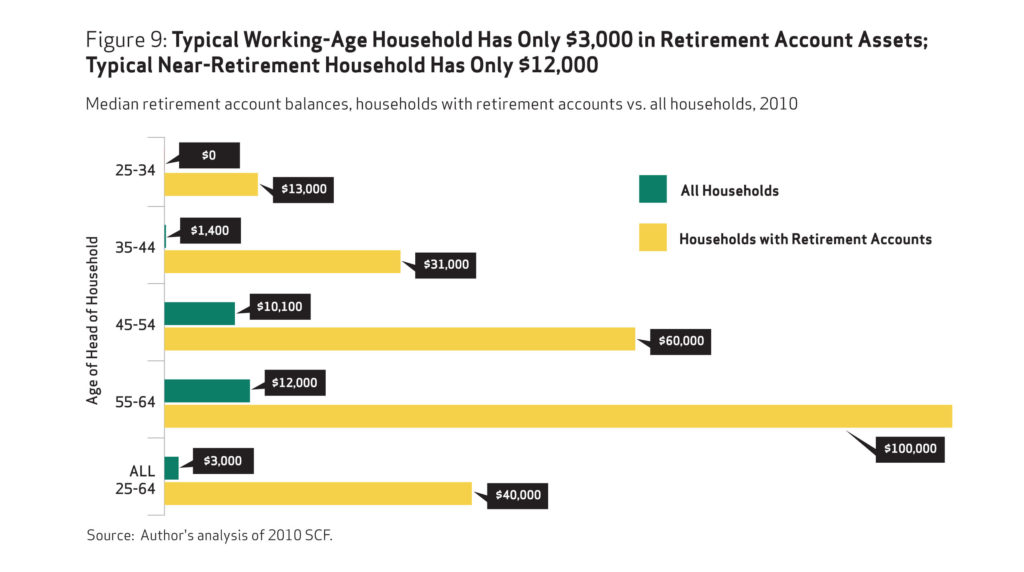

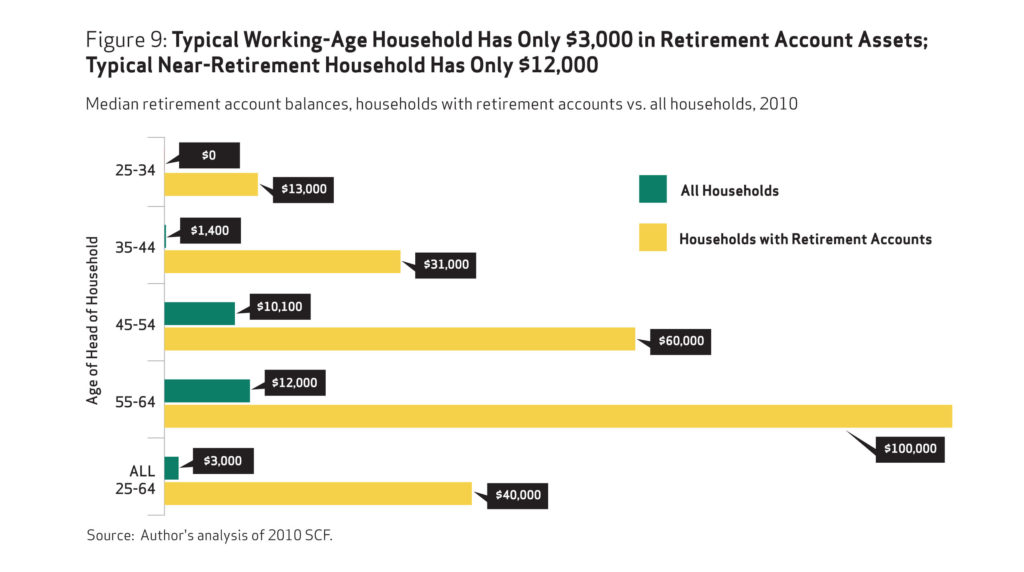

The average working household has virtually no retirement savings. When all households are included— not just households with retirement accounts—the median retirement account balance is $3,000 for all working-age households and $12,000 for near-retirement households.

The findings confirm that the American Dream of retiring comfortably after a lifetime of work will be impossible for many. Based on 401(k)–type account and IRA balances alone, some 92 percent of working households do not meet conservative retirement savings targets for their age and income. Even when counting their entire net worth, 65 percent still fall short.

The key research findings are as follows:

- Account ownership rates are closely correlated with income and wealth. More than 38 million working-age households (45 percent) do not own any retirement account assets, whether in an employer-sponsored 401(k) type plan or an IRA. Households that do own retirement accounts have significantly higher income and wealth—more than double the income and five times the non-retirement assets—than households that do not own a retirement account.

- The average working household has virtually no retirement savings. When all households are included— not just households with retirement accounts—the median retirement account balance is $3,000 for all working-age households and $12,000 for near-retirement households. Two-thirds of working households age 55-64 with at least one earner have retirement savings less than one times their annual income, which is far below what they will need to maintain their standard of living in retirement.

- The collective retirement savings gap among working households age 25-64 ranges from $6.8 to $14 trillion, depending on the financial measure. A large majority of households fall short of conservative retirement savings targets for their age and income based on working until age 67. Based on retirement account assets, 92 percent of working households do not meet targets. Under broader measures, most households still have insufficient assets: 90 percent fall short based on retirement account balances and estimated DB pension assets combined, 84 percent fall short based on total financial assets, and 65 percent fall short based on net worth.

- Public policy can play a critical role in putting all Americans on a path toward a secure retirement by strengthening Social Security, expanding access to low-cost, high quality retirement plans, and helping low-income workers and families save. Social Security, the primary edifice of retirement income security, could be strengthened to stabilize system financing and enhance benefits for vulnerable populations. Access to workplace retirement plans could be expanded by making it easier for private employers to sponsor DB pensions, while national and state level proposals aim to ensure universal retirement plan coverage. Finally, expanding the Saver’s Credit and making it refundable could help boost the retirement savings of lower-income families.