PENSION SPENDING SUPPORTS 7.5 MILLION JOBS, $1.2 TRILLION IN ECONOMIC OUTPUT ACROSS THE U.S.

Real Estate, Food Services, Health Care, and Retail Sectors See Biggest Employment Impacts

Webcast on January 10th at 2 PM ET to Review Findings

WASHINGTON, D.C., January 10, 2019 – A new report finds that economic gains attributable to defined benefit (DB) pensions in the U.S. are substantial. Retiree spending of pension benefits in 2016 generated $1.2 trillion in total economic output, supporting some 7.5 million jobs across the U.S. Pension spending also added a total of $202.6 billion to government coffers, as taxes were paid at federal, state and local levels on retirees’ pension benefits and their spending in 2016.

Pensionomics 2018: Measuring the Economic Impact of Defined Benefit Pension Expenditures, released today by the National Institute on Retirement Security, reports the national economic impacts of public and private pension plans, as well as the impact of state and local plans on a state-by-state basis.

Pensionomics 2018: Measuring the Economic Impact of Defined Benefit Pension Expenditures, released today by the National Institute on Retirement Security, reports the national economic impacts of public and private pension plans, as well as the impact of state and local plans on a state-by-state basis.

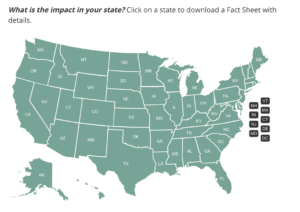

The full report is available here. A map with downloadable state fact sheets is available here. Register for the webcast here.

“The analysis shows that virtually every state and local economy across the country benefits from the spending when retirees spend their pension benefits,” said Diane Oakley, NIRS executive director. “Pension expenditures are especially vital for small and rural communities where other steady sources of income may not be readily found if the local economy lacks diversity.”

For example, when a retired nurse receives a pension benefit payment, s/he spends the pension check on goods and services in the local community. S/he purchases food, clothing, and medicine at local stores, and may even make larger purchases like a car or laptop computer. These purchases, combined with those of other retirees with pensions, create a steady economic ripple effect. In short, pension spending supports the economy and supports jobs where retirees reside and spend their benefits.

For example, when a retired nurse receives a pension benefit payment, s/he spends the pension check on goods and services in the local community. S/he purchases food, clothing, and medicine at local stores, and may even make larger purchases like a car or laptop computer. These purchases, combined with those of other retirees with pensions, create a steady economic ripple effect. In short, pension spending supports the economy and supports jobs where retirees reside and spend their benefits.

This study finds that in 2016:

$578.0 billion in pension benefits were paid to 26.9 million retired Americans, including:

- $294.7 billion paid to some 10.7 million retired employees of state and local government and their beneficiaries (typically surviving spouses);

- $83.0 billion paid to some 2.7 million federal government beneficiaries;

- $200.3 billion paid to some 13.5 million private sector beneficiaries, including:

- $41.8 billion paid out to 3.5 million beneficiaries of multi-employer pension plans, and

- $158.6 billion paid out to 10.0 million beneficiaries of single-employer pension plans.

Expenditures made out of those payments collectively supported:

- 5 million American jobs that paid nearly $386.7 billion in labor income;

- $1.2 trillion in total economic output nationwide;

- $685.0 billion in value added (GDP); and

- $202.6 billion in federal, state, and local tax revenue.

DB pension expenditures have large multiplier effects:

- Each dollar paid out in pension benefits supported $2.13 in total economic output nationally.

- Each taxpayer dollar contributed to state and local pensions supported $8.48 in total output nationally. This represents the leverage afforded by robust long-term investment returns and shared funding responsibility by employers and employees.

The largest employment impacts occurred in the real estate, food services, health care and retail trade sectors.

The purpose of this study is to quantify the economic impact of pension payments in the U.S. and in each of the 50 states and the District of Columbia. Using the IMPLAN model, the analysis estimates the employment, output, value added, and tax impacts of pension benefit expenditures at the national and state levels. Because of methodological refinements explained in the Technical Appendix, , the state level results are not directly comparable to those in previous versions of this study.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS’ diverse membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @nirsonline.

Contact: Kelly Kenneally | kkenneally@nirsonline.org | 202.457.8190

##