August 14, 2008, Washington, D.C. – A new report finds a defined benefit (DB) pension can deliver the same retirement income at 46% lower cost than an individual defined contribution (DC) account.

The analysis calculates that DB pension plans:

- Avoid the problem of “over-saving” by pooling the longevity risks of large numbers of individuals – resulting in a 15% cost savings.

- Are ageless and therefore can perpetually maintain an optimally balanced investment portfolio rather than the typical individual strategy of down-shifting over time to a lower risk/return asset allocation – resulting in a 5% cost savings.

- Achieve higher investment returns as compared to individual investors because of professional asset management and lower fees – resulting in a 26% cost savings.

The study, “A Better Bang for the Buck: The Economic Efficiencies of Defined Benefit Pension Plans,” was published by the National Institute on Retirement Security. NIRS will host a press conference call with the report authors on Thursday, August, 14, 2008, at 11:00 AM ET (see dial in information below).

“The analysis is somewhat of a myth buster when it comes to conventional wisdom on the cost of retirement plans,” said Beth Almeida, report author and Executive Director of the National Institute on Retirement Security. She added, “The analysis clearly indicates that the qualities inherent in DB plans – particularly, the pooling of risks and assets – fuel their fiscal efficiency. Importantly, the report provides a new lens for policymakers, employers and employees, who are struggling to ensure adequate retirement income with the fewest dollars possible.”

“Our model makes an ‘apples to apples’ calculation of the actual dollar contributions required for a DB and DC plan to achieve the same target retirement benefit,” said William (Flick) Fornia, report author and Senior Vice President with Aon Consulting. He added, “The efficiencies of DB plans already are well documented. This report, however, is important in terms of quantifying the magnitude of those efficiencies.”

The model was based on a group of 1,000 newly hired 30 year old female teachers who work for three years, take a two year leave to have children, work for a total of 30 years, and then retire at age 62 with a final salary of $50,000. The target annual pension benefit for the model is $26,684, or $2,224 monthly with cost of living adjustments. Together with Social Security benefits, each teacher can expect to receive roughly 83% of her pre-retirement income, which meets the generally accepted standard of retirement income adequacy.

The model calculates that the cost to fund the target retirement benefit under the DB plan is 12.5% of payroll each year, while the cost to provide the same target retirement benefit under the DC plan is 22.9% of payroll each year. In other words, the DB plan can provide the same benefit at a cost that is 46% lower than the DC plan.

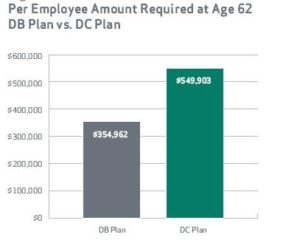

In dollar terms, the DB plan needs to have accumulated approximately $355,000 for each participant in the plan by the time they turn 62, while the DC plans must accumulate almost $550,000 per participant (Figure 2). This difference – almost $200,000 per participant – illustrates the large dollar savings that DB plans yield for employers, employees, and taxpayers.

The report also indicates that DC plans are essential to the retirement security equation. DC plans enable workers the save for retirement in a manner that reflects their individual situations. Most retirement experts indicate that retirement security can be achieved with a “three-legged stool” consisting of Social Security, a DB plan, and a supplemental DC savings plan. Workers who have access to all three sources of retirement income are in the best position to achieve a secure retirement.

The full report can be accessed here.

NIRS will host a conference call with the authors on Thursday, August, 14, 2008, at 11:00 AM ET to review the report and respond to questions. Interested parties can dial 800.553.0318 in the United States, and international callers can access the call at +1.612.332.0345. An audio replay will be available for 30 days following the call by dialing 800.475-6701 and providing 956940 as the access code.

About NIRS

The National Institute on Retirement Security is a not-for-profit organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers, and the economy through national research and education programs. Located in Washington, D.C., NIRS seeks to encourage the development of public policies that enhance retirement security in America.