February 26, 2009, Washington, D.C. – An economic impact analysis finds state & local government pension benefits have a sizable impact that ripples through every state and industry across the nation.

The new report, “Pensionomics: Measuring the Economic Impact of State and Local Pension Plans,” finds that expenditures made from state & local pension benefits for fiscal year 2005-2006:

- Had a total economic impact of more than $358 billion.

- Supported more than 2.5 million American jobs that paid more than$92 billion in total compensation to American workers.

- Supported more than $57 billion in annual federal, state, local tax revenue.

- Paid $151.7 billion in pension benefits to 7.3 million retirees and beneficiaries.

- Had large multiplier effects. Each taxpayer dollar invested in state and local pensions supported $11.45 in total economic activity, while each dollar paid out in benefits supported $2.36 in economic activity.

- Had the largest impact on the manufacturing, health care, finance, retail trade, and accommodation and food service sectors.

The report also analyzes the economic impact of public pensions in each of the 50 states. State Fact Sheets with these findings are available here. State Press Releases are here.

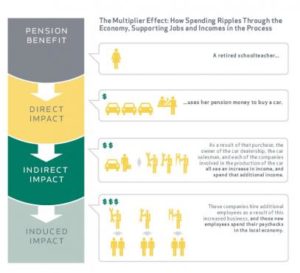

“This study measures the magnitude of the ‘multiplier effect’ of state and local pensions in the U.S. economy,” said Ilana Boivie , NIRS policy analyst and report co-author. “The multiplier effect occurs because one retiree’s spending becomes another person’s income,” she said.

Boivie explained, “For example, a retired teacher may spend his or her pension check to pay the gas bill, buy a car, or make purchases at the local pharmacy, grocery store, or movie theatre. As a result of the retiree’s spending, businesses see an increase in their income, which then enables businesses to spend and create jobs. Each successive round of spending ripples through the economy to generate an economic impact that is much larger than the initial spending by the retiree.”

“Understanding the considerable economic impact of state and local pensions is vital given the severe financial crisis facing America,” said Beth Almeida, NIRS executive director and report co-author. “Economists have long known that the steady monthly income provided by pensions can act as an ‘automatic stabilizer.’ That is, retirees with a stable monthly pension income can continue to spend on basic needs, even during an economic downturn. In contrast, retirees relying solely on plummeting 401(k)s or individual retirement accounts likely are forced to retreat from spending precisely at the time when the economy most needs stimulus,” Almeida explained.

The analysis was conducted using data from the U.S. Census Bureau and IMPLAN, an input-output modeling software widely used by industry and governments analysts.

The full report is available at www.nirsonline.org along with State Fact Sheets.

NIRS will hold a conference call regarding the findings on Thursday, February 26, 2009 at 11 AM ET by dialing (800) 230-1074, Confirmation Number: 988166.

A live PowerPoint presentation will be available online during the conference call. Log on to the web conference by visiting www.gotomeeting.com. On the left hand column of the page, click “Join Meeting.” When prompted, enter Meeting Number 193-429-659. Enter the requested information to access the presentation.

The Report, State Fact Sheets, and PowerPoint Presentation will be available in advance of the call at www.nirsonline.org on Feb. 26th at 9 AM ET.

An audio digitized replay of the call will be available from February 26, 2009 at 1 PM ET through March 26, 2009 at 11:59 PM ET by dialing (800) 475-6701, Access Code 988166.

ABOUT NIRS

NIRS is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers, and the economy as a whole. Located in Washington, D.C., NIRS’s membership includes employee benefit plans, agencies that manage retirement plans, trade associations, financial services firms, and other retirement service providers.