AMID DEEP POLITICAL DIVISION, AMERICANS UNITED IN WORRY ABOUT RETIREMENT, ACCORDING TO NEW RESEARCH FROM THE NATIONAL INSTITUTE ON RETIREMENT SECURITY

More Than Half of Americans Say the COVID-19 Pandemic Has Increased Retirement Concerns

Vast Majority Agree Social Security Should Remain A Priority, With Half Supporting Expansion

Webinar on February 25th at 2 PM ET to Review Findings

WASHINGTON, D.C., February 18, 2021 – A new report finds that despite a highly divisive political climate, Americans across party lines share concerns about their financial security in retirement. The vast majority of Democrats (70 percent), Independents (70 percent) and Republicans (62 percent) agree that the nation faces a retirement crisis. There also is bi-partisan agreement that the average worker cannot save enough on their own to guarantee a secure retirement, along with broad support for Social Security and pensions.

share concerns about their financial security in retirement. The vast majority of Democrats (70 percent), Independents (70 percent) and Republicans (62 percent) agree that the nation faces a retirement crisis. There also is bi-partisan agreement that the average worker cannot save enough on their own to guarantee a secure retirement, along with broad support for Social Security and pensions.

This national survey of working-age Americans also reveals that the COVID-19 pandemic has exacerbated worries about achieving financial security in retirement. More than half of Americans (51 percent) say that the COVID-19 pandemic has increased concerns about achieving financial security in retirement. And the COVID-19 concern is high across party lines: 57 percent among Democrats; 50 percent for Independents; and at 44 percent for Republicans.

Retirement Insecurity 2021|Americans’ Views of Retirement presents the results of a national survey conducted by Greenwald Research to measure sentiment on a broad range of retirement issues. The full report is available here. Register here for a webinar scheduled for Thursday, February 25, 2021, at 2 PM ET to review the findings.

“Today’s COVID-19 job losses, furloughs and pay cuts will further damage Americans’ ability to have a secure retirement. This new research shows the deep economic impacts of the pandemic have only increased Americans’ retirement anxiety,” said Dan Doonan, NIRS executive director and report co-author.

“We also found that retirement anxiety transcends political affiliation. Across party lines, Americans are frustrated with policymakers and that they can’t save enough on their own to be self-sufficient in retirement. As such, enacting retirement policy solutions would be a win-win for policymakers and the country, delivering financial relief for working families on an issue that concerns Americans on both sides of the aisle,” Doonan explained.

“We also found that retirement anxiety transcends political affiliation. Across party lines, Americans are frustrated with policymakers and that they can’t save enough on their own to be self-sufficient in retirement. As such, enacting retirement policy solutions would be a win-win for policymakers and the country, delivering financial relief for working families on an issue that concerns Americans on both sides of the aisle,” Doonan explained.

In terms of retirement policy, the research indicates that Americans are highly supportive of Social Security (79 percent), and there even is some support for expanding the program. And, most Americans (60 percent) agree that it makes sense to increase the amount that workers and employers contribute to Social Security to ensure it will be around for future generations. Americans also are highly supportive of pensions (76 percent), and see these plans as better than 401(k) savings accounts for providing retirement security. Three-fourths of Americans say that all workers should have access to a pension plan so they can be independent and self-reliant in retirement.

The research key findings are as follows:

- The COVID-19 pandemic has impacted many Americans’ concerns and plans for retirement. More than half of Americans (51 percent) say that the COVID-19 pandemic has increased concerns about their ability to achieve financial security in retirement. Among Americans who have changed or considered changing when they will retire, sixty-seven percent say that because of COVID-19, they plan to retire later than originally planned.

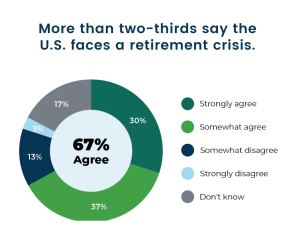

- A large swath of Americans is concerned about their economic security in retirement. More than two-thirds of Americans (67 percent) say the nation faces a retirement crisis. More than half (56 percent) are concerned that they won’t be able to achieve a financially secure retirement. Some 68 percent say the average worker cannot save enough on their own to guarantee a secure retirement. And 65 percent of current workers say it’s likely they will have to work past retirement age to have enough money to retire.

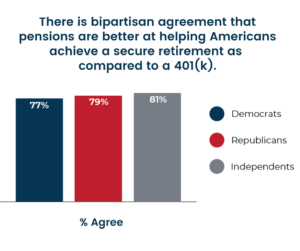

- The nation is highly polarized, but Americans are united in their worry about retirement issues. The vast majority of Democrats (70 percent), Independents (70 percent) and Republicans (62 percent) agree that the nation faces a retirement crisis. Americans also are united in their frustration that policymakers do not understand their retirement savings struggle. When it comes to Social Security, there is strong bi-partisan support for protecting this program, but mixed views about expanding it. Americans across party lines have a positive sentiment about pension plans and support making these retirement plans more available to workers.

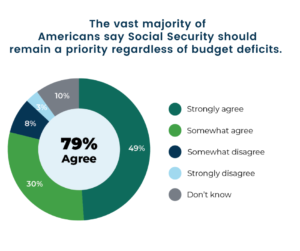

- Americans are highly supportive of Social Security, and there is some support for expanding the program. The vast majority of Americans (79 percent) agree that Social Security should remain a priority of the nation no matter the state of budget deficits, with nearly half (49 percent) in strong agreement. Most Americans (60 percent) agree that it makes sense to increase the amount that workers and employers contribute to Social Security to ensure it will be around for future generations. And half support expanding Social Security, with 25 percent saying it should be expanded for all Americans and 25 percent saying it should be expanded except for wealthier households.

- When it comes to pensions, Americans have highly favorable views about their role in the retirement equation and see these plans as better than 401(k) savings accounts. Seventy-six percent of Americans have a favorable view of defined benefit pensions. Seventy-five percent say that all workers should have access to a pension plan so they can be independent and self-reliant in retirement. Sixty-five percent agree that pensions are better than 401(k) accounts for providing retirement security.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @NIRSonline.