A new research brief finds that financial asset inequality among Americans continues to increase, and the inequality is consistent across generations. This wealth inequality, combined with dangerously low retirement savings among most households, poses a significant threat to retirement for working Americans.

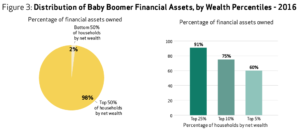

The new analysis indicates that from 2004 to 2016, the share of financial assets owned by the top 25 percent of Baby Boomer households grew from 86 percent to 91 percent. Meanwhile, the share of assets owned by the bottom 50 percent of Baby Boomer households shrank from three percent in 2004 to below two percent in 2016.

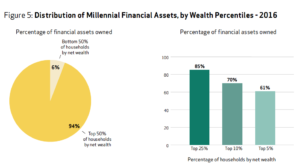

Among GenX households, the wealthiest top 25 percent owned 87 percent of financial assets in 2016. Millennials in 2016 reached a comparable degree of financial asset concentration, with 85 percent of financial assets owned by the wealthiest 25 percent.

The research brief also recommends three well-established public policies to help improve retirement security for working Americans:

- Strengthen and expand Social Security.

- Support state efforts to establish state-facilitated retirement savings plans in order to facilitate asset building among the roughly half of U.S. private sector workers who lack access to a workplace retirement plan.

- Promote and improve the federal Saver’s Credit to help build the retirement savings of low-income households.