New Research Finds Growing Financial Asset Inequality

Persistent Concentration of Financial Assets Among the Wealthiest Coupled with Low Savings Poses Retirement Threat to Working Americans

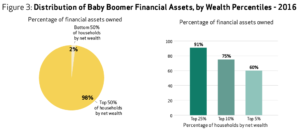

Among Baby Boomers, Top 25 Percent Own 91 Percent of Financial Assets; Similar Inequality Among GenX and Millennial Generations

Webinar on Tuesday, October 1st at 2 PM ET to Review Findings

WASHINGTON, D.C., September 25, 2019 – A new research brief finds that financial asset inequality among Americans continues to increase, and the inequality is consistent across generations. This wealth inequality, combined with dangerously low retirement savings among most households, poses a significant threat to retirement for working Americans.

The new analysis indicates that from 2004 to 2016, the share of financial assets owned by the top 25 percent of Baby Boomer households grew from 86 percent to 91 percent. Meanwhile, the share of assets owned by the bottom 50 percent of Baby Boomer households shrank from three percent in 2004 to below two percent in 2016.

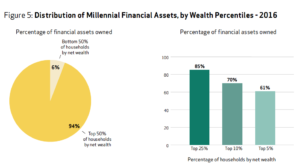

Among GenX households, the wealthiest top 25 percent owned 87 percent of financial assets in 2016. Millennials in 2016 reached a comparable degree of financial asset concentration, with 85 percent of financial assets owned by the wealthiest 25 percent.

These findings are detailed in a new research brief from the National Institute on Retirement Security, Financial Asset Inequality and Its Implications for Retirement Security, available here.

A webinar reviewing the findings is scheduled for Tuesday, October 1, 2019, at 2:00 PM ET. Register at no charge here.

“The expanding wealth chasm is putting retirement even further out of reach for working Americans,” said Tyler Bond, NIRS manager of research and co-author of the research brief. “Fewer and fewer workers are offered pensions, which means they must amass enough financial assets on their own to last through retirement. But our research shows this just isn’t happening. Instead, financial assets increasingly are concentrated among the wealthiest Americans, and there is a growing inequality in access to employer-sponsored plans that serve as a vital pillar of our retirement infrastructure. Unless something changes, retirement will become a luxury, and many Americans will miss out on this aspect of the American Dream.”

“There’s strong evidence that financial asset inequality will continue to grow worse in the coming decades,” said Nari Rhee, director of the Retirement Security Program at UC Berkeley Center for Labor Research and Education and report co-author. “Financial asset concentration among the wealthiest Gen X households is growing at least as fast as it did among Baby Boomers. And Millenials seem to have achieved comparable degree of financial asset concentration at much younger ages than GenXers and Baby Boomers,” she explained.

A 2018 NIRS report found deeply inadequate retirement savings levels among working age Americans. More specifically, an analysis of U.S. Census Bureau data reveal that the median retirement account balance among all working individuals is $0.00, and 57 percent of working age individuals do not own any retirement account assets in an employer-sponsored 401(k)-type plan, individual account or pension.

This new issue brief reproduces the methodology of a 2006 Government Accountability Office (GAO) report, Retirement of Baby Boomers is Unlikely to Precipitate Dramatic Decline in Market Returns, but Broader Risks Threaten Retirement Security. The purpose of the report was to consider the likelihood of a meltdown in financial markets caused by Baby Boomers selling their financial assets to finance their retirement. GAO concluded that this was highly unlikely because the ownership of financial assets among Baby Boomers was highly concentrated at the top of the wealth spectrum.

Today’s new issue brief also recommends three well-established public policies to help improve retirement security for working Americans:

- Strengthen and expand Social Security.

- Support state efforts to establish state-facilitated retirement savings plans in order to facilitate asset building among the roughly half of U.S. private sector workers who lack access to a workplace retirement plan.

- Promote and improve the federal Saver’s Credit to help build the retirement savings of low-income households.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers, and the economy as a whole. Located in Washington, D.C., NIRS’ diverse membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @NIRSonline.