This report finds that economic inequality continues to grow, with Blacks and Hispanics owning only a sliver of financial assets.

Even though the Gen X and Millennial generations are more diverse, whites continue to dominate when it comes to accumulating financial assets. This economic inequality ultimately translates into financial insecurity in retirement, which is exacerbated by the shift from pensions to individual 401(k) savings accounts.

Stark Inequality: Financial Asset Inequality Undermines Retirement Security report findings are as follows:

Inequality in the ownership of financial assets both persists and deepens over time. The top five percent of Baby Boomers by net worth owned a greater percentage of that generation’s financial assets in 2019 (58 percent) than in 2004 (52 percent).

Inequality in the ownership of financial assets both persists and deepens over time. The top five percent of Baby Boomers by net worth owned a greater percentage of that generation’s financial assets in 2019 (58 percent) than in 2004 (52 percent).- Inequality in the ownership of financial assets is consistent across generations. In 2019, the top 25 percent by net worth of Millennials, Generation X, and Baby Boomers owned three-quarters or more of their generation’s financial assets.

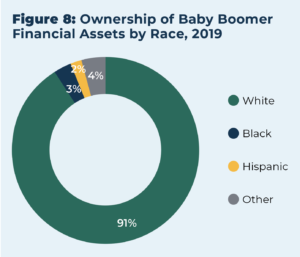

- Financial asset ownership is highly concentrated among white households. In 2019, white households in all three generations owned three-quarters or more of their generation’s financial assets. Ownership is especially concentrated among white households in the top 25 percent of net worth.

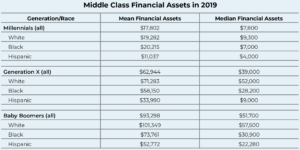

- Both mean and median financial assets were significantly higher for white households in 2019 than Black or Hispanic households.

- The middle class in 2019 only owned a fairly small percentage of financial assets. Middle class Millennials owned 14 percent of their generation’s financial assets, while Gen X and Baby Boomers owned 8 and 6 percent respectively.

- A range of potential solutions exists to address this stark inequality including strengthening and expanding Social Security, protecting pensions, increasing access to savings-based plans for low-income workers, and reforming retirement tax incentives.

This research is based upon data from the Federal Reserve’s Survey of Consumer Finances. It examines financial asset ownership by net worth, generation, and race, and considers three generational cohorts: Millennials, Generation X, and Baby Boomers. Millennials are assessed in 2016 and 2019, while Generation X and Baby Boomers are assessed in 2004, 2010, 2016, and 2019. The research examines financial assets, a broader category than retirement assets.