NEW STUDY ANALYZES TEACHER PENSION PLANS IN SIX STATES

Data Reveal Pensions Have Important Retention Impact, Provide Substantially Greater Retirement Security than 401(k)-Style Accounts

Webinar on January 17th at 2 PM ET to Review Findings

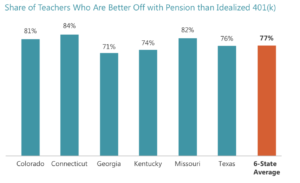

WASHINGTON, D.C., January 8, 2019 – A new report finds that teacher pension plans play a critical role in retaining educators while also providing greater retirement security than 401(k)-style retirement accounts. Eight out of ten educators serving in the six states studied can expect to collect pension benefits that are greater in value than what they could receive under an idealized 401(k)-type plan. The study also finds that the typical teacher in these states that offer pensions will serve 25 years in the same state, while two out of three educators will teach for at least 20 years.

Teacher Pension vs 401ks in Six States Cover ImageThese findings are featured in new research, Teacher Pensions vs. 401(k)s in Six States: Colorado, Connecticut, Georgia, Kentucky, Missouri and Texas, from the UC Berkeley Center for Labor Research and Education (Labor Center) and the National Institute on Retirement Security. The report is author by Dr. Nari Rhee, director of the Retirement Security Program at the UC Berkeley Labor Center, and Leon (Rocky) Joyner, vice president and actuary with Segal Consulting.

Download the report here. Register for the webinar here.

“In the six states analyzed, we find that pensions are significantly better matched to a teacher’s career than 401(k) accounts and that switching away from pensions would sharply reduce the retirement security of education professionals,” says report co-author Nari Rhee. “Moreover, we find that teacher pensions are a critical workforce retention tool, which is a key consideration as public schools in many communities face teacher shortages.”

“In the six states analyzed, we find that pensions are significantly better matched to a teacher’s career than 401(k) accounts and that switching away from pensions would sharply reduce the retirement security of education professionals,” says report co-author Nari Rhee. “Moreover, we find that teacher pensions are a critical workforce retention tool, which is a key consideration as public schools in many communities face teacher shortages.”

The study analyzes teacher turnover patterns and projects the final tenure for the current teaching workforce using retirement system actuarial assumptions. Then, the study compares benefits for current teachers under the existing pension and a hypothetical 401(k) account with the same contribution rate as the pension. Importantly, the analysis was weighted to reflect the real-life teaching workforce in each state.

“The evidence is clear that pensions have a magnetic effect on the education workforce and are the most cost-efficient means of providing teachers with a stable and secure income in retirement,” says Diane Oakley, NIRS executive director. “It’s a win-win to provide teachers with pensions because it keeps experienced educators in the classroom while simultaneously providing teachers with retirement security. Thanks to this study, we can put to rest false claims about the adequacy and fairness of teacher pensions,” Oakley explained.

“The evidence is clear that pensions have a magnetic effect on the education workforce and are the most cost-efficient means of providing teachers with a stable and secure income in retirement,” says Diane Oakley, NIRS executive director. “It’s a win-win to provide teachers with pensions because it keeps experienced educators in the classroom while simultaneously providing teachers with retirement security. Thanks to this study, we can put to rest false claims about the adequacy and fairness of teacher pensions,” Oakley explained.

The research finds that:

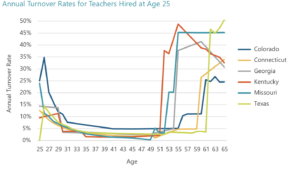

- Most classroom teaching is performed by long-career teachers who are well-positioned to benefit from a traditional pension. On average in the six states, the typical teacher will serve 25 years in the same state while two out of three educators will teach for at least 20 years.

- For eight out of ten teachers in the six states analyzed, pensions provide higher, more secure retirement income compared to a 401(k)-style plan. An average of 77 percent of teachers will stay long enough in the same retirement system to earn greater, more secure benefits from the lowest-tier pension compared to an idealized 401(k) with low fees and no investment mistakes. Compared to a realistic 401(k) with typical individual investor returns, existing pensions are better for 81 percent of teachers.

- Conversely, only two out of ten teachers in the six states will accrue less benefit under the lowest-tier pension offered by their state, compared to an idealized 401(k)-style plan. Across the six states, only 23 percent of teachers will not accumulate enough service in the same retirement system to earn pension benefits from the lowest-tier pension that are greater than benefits from an idealized 401(k). Only 19 percent are better off with a realistic 401(k) than with a pension.

- In all six states, most teachers would require substantially higher contributions to realize the same retirement income in a 401(k) as the lowest-tier pension. The magnitude of increased cost varies due to differences in teacher demographics and pension benefit structure. Based on median age at hire and median projected service, it would cost 20 percent more to fund a typical Georgia teacher’s retirement benefit. For those in Colorado, Connecticut, and Kentucky, it would cost roughly 40 percent more. In Missouri and Texas, a 401(k) would require twice the pension contributions for a typical teacher.

Given these data findings, the report offers four key implications for any policymakers considering pension reform:

- As teacher shortages worsen, it is important to consider that pensions exert a clear retention effect on experienced teachers, lowering turnover and contributing to education quality.

- Shifting from pensions to 401(k)s to other account-based plans will increase turnover and significantly reduce the retirement incomes of long-term teachers who conduct most classroom teaching.

- Shifting to 401(k)s will decrease the aggregate retirement income of teachers, reducing future consumer spending in the state.

- States concerned about equity between short- and long-term teachers should consider restoring or augmenting portability provisions in existing pensions, such as service credit purchases, pension system reciprocity, matching employee contribution refunds, and allowing non-vested employees to purchase lifetime income. Colorado PERA stands out as a system that provides attractive benefits to teachers and other public servants regardless of tenure.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS’ diverse membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @nirsonline.

##