DESPITE POLITICAL POLARIZATION, DEMOCRATS, REPUBLICANS AND INDEPENDENTS UNITED IN CONCERN ABOUT U.S. RETIREMENT CRISIS

Majority of Americans Say They Can’t Achieve Financial Security in Retirement and New Tax Law Isn’t Helping; Millennials Most Pessimistic But Most Willing to Save More

Findings Released During Live Webcast of 10th Annual Retirement Conference

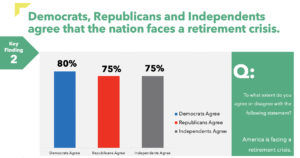

WASHINGTON, D.C., February 26, 2019 – Despite deep political polarization, Americans are united in their concern about retirement. In overwhelming numbers, Americans say the nation faces a retirement crisis, with Democrats at 80 percent, Republicans at 75 percent, and Independents at 75 percent.

New research also finds that Americans see government playing an important role in helping workers prepare for retirement, but lawmakers in Washington aren’t delivering results – and the new tax law has not helped. Only 34 percent say the tax overhaul passed last year is helping on the retirement front, 84 percent say leaders in Washington have no idea how hard it is to prepare for retirement, and 80 percent say government should ease the way for employers to offer pensions.

New research also finds that Americans see government playing an important role in helping workers prepare for retirement, but lawmakers in Washington aren’t delivering results – and the new tax law has not helped. Only 34 percent say the tax overhaul passed last year is helping on the retirement front, 84 percent say leaders in Washington have no idea how hard it is to prepare for retirement, and 80 percent say government should ease the way for employers to offer pensions.

These findings are contained in a new research, Retirement Insecurity 2019: Americans’ Views of the Retirement Crisis, available here. The findings are published by the National Institute on Retirement (NIRS) and based on research conducted by Greenwald & Associates. The findings will be reviewed today at the NIRS annual retirement policy conference in Washington, D.C. Watch a live webcast of the conference here. Download the research here.

The research also indicates that about two-thirds of Americans believe that pensions are better than 401(k) accounts in terms of ensuring retirement security. Also, Millennials are the most worried about a financially secure retirement (72 percent),and is the generation most willing to put away more money now for retirement (60 percent).

“Americans are divided on so many issues, but not when to comes to their economic insecurity in retirement. Democrats, Republicans and Independents alike are concerned that they won’t be able to achieve financial security in retirement and that managing investments in retirement is problematic,” said Diane Oakley, NIRS executive director.

“Americans are divided on so many issues, but not when to comes to their economic insecurity in retirement. Democrats, Republicans and Independents alike are concerned that they won’t be able to achieve financial security in retirement and that managing investments in retirement is problematic,” said Diane Oakley, NIRS executive director.

“While Americans are disappointed with national political leadership on retirement policies, they are highly supportive of state efforts to bolster retirement readiness. We find that 74 percent of Americans would participate in these new state-sponsored retirement plans, and that portability and monthly income are features that drive their support,” Oakley said.

“If the new Congress is serious about addressing Americans’ retirement anxiety, a bold first step would be strengthen Social Security and make it easier for companies to offer pensions. A majority of Americans agree that government needs to increase Social Security contributions from both employers and workers, and 76 percent say that the disappearance of pensions is killing the American dream,” Oakley explained.

The key research findings are as follows:

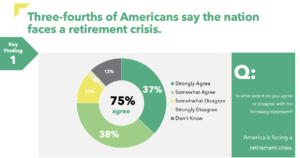

- In overwhelming numbers, Americans are worried about their ability to attain and sustain financial security in their older years. Three-fourths of Americans say the nation faces a retirement crisis. Some 70 percent say the average worker cannot save enough on their own to guarantee a secure retirement. And 65 percent say it’s likely they will have to work past retirement age to have enough money to retire.

- Even as the nation remains deeply politically polarized, Americans are united in their sentiment about retirement issues. Democrats (80 percent), Republicans (75 percent)and Independents (75 percent) agree that the nation faces a retirement crisis. Across party lines, Americans have highly favorable views about pensions (Democrats at 80 percent, Republicans at 81 and Independents at 75 percent). Despite party affiliation, Americans agree that leaders in Washington don’t understand how hard it is to prepare for retirement (Democrats at 87 percent, Republicans at 81percent and Independents at 84 percent).

- Americans see government playing an important role in helping workers prepare for retirement, but lawmakers in Washington, D.C. just don’t get it. And the new tax law has not helped. Some 84 percent say leaders in Washington have no idea how hard it is for American workers to prepare for retirement. More than half agree that government needs to increase Social Security contributions from both employers and workers. Few Americans (34 percent) see the new tax law as improving their retirement prospects.

- In contrast to the sentiment about Washington, D.C., efforts by state lawmakers to expand access to retirement accounts for all workers is widely supported by Americans. Americans overwhelmingly agree (71 percent) that state-based retirement plans are a good idea, and 74 percent of Americans say they would participate in state retirement plans. Americans view key features of state-based retirement plans as highly favorable, especially portability (90 percent), monthly checks (90 percent) and higher returns (86 percent).

- Americans are highly positive on the role of pensions in providing retirement security and see these retirement plans as better than 401(k) plans. More than three-fourths of Americans have a favorable view of defined benefit pensions. Some 64 percent say pensions are better than 401(k) accounts in terms of ensuring retirement security. And, 77 percent say those with pensions likely to feel more comfortable retiring than those relying on individual savings.

- There is strong support for pension plans for state and local workers, and Americans see these retirement plans as a tool to recruit and retain public workers. Some 82 percent say police officers & fire fighters deserve a pension because they have risky jobs, while 74 percent say teachers deserve pensions to compensate for low pay. The overwhelming majority (79 percent) say all workers, not just state and local workers, should have a pension. Some 83 percent say pensions are a good way to recruit state and local workers.

- Millennials are the most concerned about financial security in retirement, and are more willing than other generations to save more. Millennials are the most pessimistic (72 percent) generation about achieving financial security in retirement. Millennials are the generation most likely to believe they will have to work past normal retirement age (77 percent) to have a secure retirement. More than half of Millennials are willing to save five percent or more to help ensure a financially secure retirement, which is more than double the response for that level of savings from Boomers and GenX.

Information for this study was collected from online interviews between January 7–16, 2019. A total of 1,250 individuals aged 25 and older completed the survey. The final data were weighted by age, gender, income, and race to reflect the demographics of Americans 25 and older. The sample was selected using the Research Now online panel. Research Now maintains one of the industry’s most comprehensive and deeply-profiled online survey panels. Panel members are recruited through a controlled mix of both online and offline methods, using “By-Invitation-Only” acquisition, making this panel more representative of the population.

Download a summary of the results here.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS’ diverse membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @nirsonline.

Contact: Kelly Kenneally | kkenneally@nirsonline.org | 202.457.8190

##