Amid Worker Shortages, New Research Examines State & Local Employee Views on Their Jobs, Pay and Benefits

Public Employees Committed to Public Service Despite High Stress and Lower Salaries; Say Benefits are a Key Recruitment and Retention Tool and Cuts Could Drive Them Out of Public Workforce

85 Percent of State & Local Millennial Employees Plan to Stay With Employer Until Eligible for Retirement or Can’t Work

Webinar on Nov. 18th at 2 PM ET to Review Findings

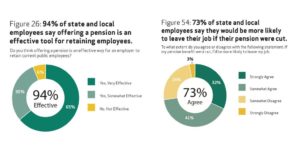

WASHINGTON, D.C., November 12, 2019 – At a time when state and local governments are struggling to attract and retain employees to deliver vital taxpayer services, a new national poll finds that retirement and healthcare benefits are critically important job features, more so than salary. These benefits are viewed as a powerful recruitment and retention tool, with nearly all state and local workers (93 percent) saying that pensions incentivize public workers to have long public service careers, and 94 percent agreeing that a pension is a good tool for both attracting and retaining employees.

WASHINGTON, D.C., November 12, 2019 – At a time when state and local governments are struggling to attract and retain employees to deliver vital taxpayer services, a new national poll finds that retirement and healthcare benefits are critically important job features, more so than salary. These benefits are viewed as a powerful recruitment and retention tool, with nearly all state and local workers (93 percent) saying that pensions incentivize public workers to have long public service careers, and 94 percent agreeing that a pension is a good tool for both attracting and retaining employees.

The research also finds that cutting benefits could have severe workforce consequences. Some 73 percent say they would be more likely to leave their job if their pension were cut, and 79 percent say they would be more likely to leave their job if their healthcare benefits were cut. Also, nearly all (92 percent) state and local employees say eliminating pensions for the public workforce will weaken governments’ ability to attract and retain qualified workers, while the vast majority say eliminating pensions would weaken public safety and the U.S. education system.

And in contrast to conventional wisdom that Millennials are “dissatisfied job hoppers,” 84 percent of Millennials working in state and local government are satisfied with their current job. Nearly three-fourths (74 percent) say a pension benefit is a major reason they chose a public sector job, while 85 percent say they plan to stay with their current employer until they are eligible for retirement or can no longer work.

These findings are contained in new research, State and Local Employee Views on Their Jobs, Pay and Benefits, available here. The findings are published by the National Institute on Retirement (NIRS) and based on research conducted by Greenwald & Associates. NIRS also has published three professions fact sheets that provide a deeper dive on the views of teachers, firefighters and law enforcement professionals. The findings will be reviewed during a webinar on Monday, November 18, 2019, at 2:00 PM ET. Register at no charge here.

These findings are contained in new research, State and Local Employee Views on Their Jobs, Pay and Benefits, available here. The findings are published by the National Institute on Retirement (NIRS) and based on research conducted by Greenwald & Associates. NIRS also has published three professions fact sheets that provide a deeper dive on the views of teachers, firefighters and law enforcement professionals. The findings will be reviewed during a webinar on Monday, November 18, 2019, at 2:00 PM ET. Register at no charge here.

“It’s clear from the research that public service is important to state and local workers like teachers, nurses, police officers, and firefighters. They serve despite high job stress and lower salaries. And it’s equally clear that healthcare and retirement benefits have a magnetic effect on public employees,” said Dan Doonan, NIRS executive director. “Understanding at a deep level these employee preferences and concerns will best position state and local policymakers to recruit and retain qualified, experienced employees that taxpayers depend upon.”

“It’s clear from the research that public service is important to state and local workers like teachers, nurses, police officers, and firefighters. They serve despite high job stress and lower salaries. And it’s equally clear that healthcare and retirement benefits have a magnetic effect on public employees,” said Dan Doonan, NIRS executive director. “Understanding at a deep level these employee preferences and concerns will best position state and local policymakers to recruit and retain qualified, experienced employees that taxpayers depend upon.”

Wyoming firefighter Kevin Reddy said, “Serving as a firefighter for the past 18 years in Wyoming is an honor, and it gives me great satisfaction to help my fellow citizens during terrifying situations. Firefighters are committed to protecting lives and property, and we are equally committed to our communities – from coaching children’s sports teams to volunteering with local charities.”

Wyoming firefighter Kevin Reddy said, “Serving as a firefighter for the past 18 years in Wyoming is an honor, and it gives me great satisfaction to help my fellow citizens during terrifying situations. Firefighters are committed to protecting lives and property, and we are equally committed to our communities – from coaching children’s sports teams to volunteering with local charities.”

“When we are on the job,” Reddy said, “firefighters are protecting our fellow citizens and providing for our families. A key part of our compensation is a pension, which we contribute to throughout our career. A pension provides financial security in retirement, and it also provides important death and disability benefits for firefighters and their families. Pensions also play a critical role in recruiting and retaining firefighters here in Wyoming, so it’s important to offer these retirement benefits. I plan to stay on the job as long as I’m able, and I appreciate having a pension at the end of my career.”

“When I served as a school superintendent in Kentucky, one of the most difficult challenges we faced was attracting and keeping teachers, particularly in rural areas,” said Tim Abrams, executive director of the Kentucky Retired Teachers Association. “Healthcare and pension benefits were the single most important workforce tool I had to keep our schools staffed with experienced teachers and education workers like bus drivers and librarians. And as we’ve seen recently in Kentucky, educators fully understand their pension and healthcare benefits are critically important to their financial security.”

The key research findings are as follows:

- State and local employees place a high value on serving the public and their community, and are generally satisfied with their job despite high stress. The vast majority (89 percent) of state and local employees are satisfied with the ability to serve the public aspect of their job. Some 85 percent are satisfied with their jobs, while 71 percent say their jobs are stressful.

- Benefits are among the most important job features for state and local employees. Health insurance is very important to 78 percent of state and local employees, and retirement benefits are very important to 73 percent. Salary is less important, at 71 percent.

- State and local employees have mixed views on the competitiveness of their salary and compensation, but the vast majority agree they could earn a higher salary in the private sector and a pension factors into the competitiveness of their compensation. Only 22 percent of state and local employees say their salaries are very competitive, and 80 percent say they could earn a higher salary in the private sector.

- Benefits are viewed as a powerful recruitment and retention tool across state and local government professions. Nearly all state and local workers (93 percent) say pensions incentivize public workers to have long public service careers, while 94 percent say offering a pension is a good tool for attracting and retaining employees. The vast majority of state and local employees (89 percent) say they plan to stay with their current employer until they are eligible for retirement or can no longer work.

- State and local government employees overwhelmingly have favorable views of pensions, with lasting retirement income and monthly checks the most important features. Some 94 percent of state and local employees have favorable views of defined benefit pensions.

- Most public workers feel they will be financially secure in retirement, but the vast majority of state and local employees are highly concerned about cuts to retirement benefits & government officials underfunding of pension plans. Nearly three-fourths (72 percent) of state and local employees are confident they will be financially secure in retirement. But, 86 percent are concerned about cuts to their retirement benefits while 85 percent are concerned about government officials underfunding their pension.

- Cutting state and local employee benefits could drive them out of the public workforce. More than half of state and local employees (58 percent) say that switching them out of a pension into an individual retirement plan, like a 401(k)-style plan, would make them more likely to leave their job. Some 73 percent say they would be more likely to leave their job if their pension were cut, and 79 percent say they would be more likely to leave their job if their healthcare benefits were cut.

- State and local employees say eliminating pensions has risks. Nearly all (92 percent) state and local employees say eliminating pensions for the public workforce will weaken governments’ ability to attract and retain qualified workers to deliver public services. The vast majority (83 percent) say eliminating pensions would weaken public safety. Similarly, 87 percent say eliminating pensions would weaken the U.S. education system.

- Millennials working in state and local government generally share the views of Baby Boomers and GenXers on their job, serving the public, pay, and benefits. Some 84 percent of Millennials working in state and local government are satisfied with their current job, while 90 percent say they are committed to serving the public. Most (80 percent) Millennial state and local employees say they could earn a higher salary in the private sector. Nearly three-fourths (74 percent) of Millennial state and local employees say a pension benefit is a major reason they chose a public sector job, while 85 percent say they plan to stay with their current employer until they are eligible for retirement or can no longer work.

Conducted by Greenwald & Associates, information for this study was collected from online interviews between August 22 through September 12, 2019. Sample was selected using two online panel providers, with 1,118 public sector employees aged 18 and older completing the survey to include 362 teachers, 284 police officers, 204 firefighters and 268 other public sector employees. The final data were weighted by age, gender, and personal income to reflect the demographics within each of these professions, and also weighted to reflect the distribution of these professions within the public sector workforce.

The National Institute on Retirement Security is a non-profit, non-partisan organization established to contribute to informed policymaking by fostering a deep understanding of the value of retirement security to employees, employers and the economy as a whole. Located in Washington, D.C., NIRS’ diverse membership includes financial services firms, employee benefit plans, trade associations, and other retirement service providers. More information is available at www.nirsonline.org. Follow NIRS on Twitter @nirsonline.

Contact: Kelly Kenneally | kkenneally@nirsonline.org | 202.457.8190